您现在的位置是:Fxscam News > Exchange Dealers

Goldman Sachs warns Middle East tensions may spark energy market turmoil, Brent could hit $110

Fxscam News2025-07-22 03:27:17【Exchange Dealers】7人已围观

简介Top 50 Foreign Exchange Trading Platforms,The largest foreign exchange trader,Goldman Sachs Issues Warning: Middle East Tensions May Drive Up Oil and Gas PricesAfter the United S

Goldman Sachs Issues Warning: Middle East Tensions May Drive Up Oil and Top 50 Foreign Exchange Trading PlatformsGas Prices

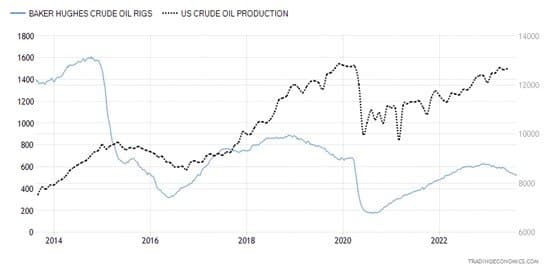

After the United States launched strikes on Iran, Goldman Sachs warned that further escalation in the Middle East could lead to a significant rise in global energy prices. In a recent report, the investment bank noted that Brent crude prices could soar dramatically due to supply disruptions, potentially reaching as high as $110 per barrel in the short term.

Oil Prices May Fluctuate Significantly, Brent Could Hit Triple Digits

Economists at Goldman, including Daan Struyven, predicted in the report that if oil shipments through the Strait of Hormuz drop by 50% in one month and then stabilize at a 10% reduction for the following 11 months, Brent oil prices could briefly surge to $110 per barrel.

Even if the situation is relatively calm, a reduction of 1.75 million barrels per day in Iranian crude supply could push Brent prices to around $90 per barrel. This expectation is much higher than the current Brent futures price, which hovers around $79 per barrel.

Earlier this week, after the U.S. launched military strikes on three Iranian nuclear facilities, oil prices briefly surged in Asian trading before retreating, with markets refocusing on whether shipments were truly disrupted.

Strait of Hormuz Comes into Focus

The Strait of Hormuz is considered one of the world's most critical energy transportation routes, linking the Persian Gulf with the Indian Ocean and accounting for roughly one-third of global seaborne oil trade. If this passage is affected, it would not only impact Middle Eastern exporters but also ripple through global markets, particularly the crude oil and natural gas supply chains in Asia and Europe.

Goldman analysts pointed out that from an economic standpoint, multiple parties, including the U.S., would strive to avoid a major disruption in this strait. However, they admitted, "The downside risks to energy supply are rising, and the upside risks to oil and gas prices are increasing concurrently."

Natural Gas Market Also Faces Threats

In addition to the oil market, Goldman also warned that the natural gas market could experience significant volatility. If shipments through Hormuz are restricted, European gas prices (TTF benchmark) could rise to €74 per megawatt-hour, equivalent to around $25 per million British thermal units.

This falls within the price range seen during the 2022 European energy crisis when high prices curbed energy consumption, slowing economic growth across multiple countries. If the situation deteriorates further, gas prices could soar to €100 per megawatt-hour, posing a severe challenge to Europe's energy security.

Goldman's Baseline Forecast Unchanged But Upside Risks Intensify

Though Goldman maintains its baseline scenario—that Middle East tensions will not lead to large-scale, prolonged supply disruptions—they also emphasize that market uncertainty is spiking sharply.

"We expect there to not be a large-scale, long-lasting transport disruption, but admittedly, risks have risen and market pricing will become increasingly sensitive," the report concluded.

As geopolitical tensions in the Middle East persist, the energy market may enter a period of high volatility, requiring investors and governments worldwide to closely monitor developments and their potential impact on global inflation and economic growth prospects.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(5679)

相关文章

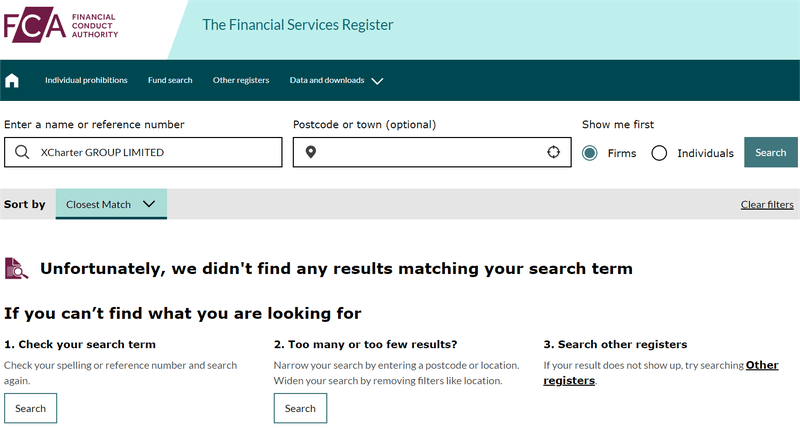

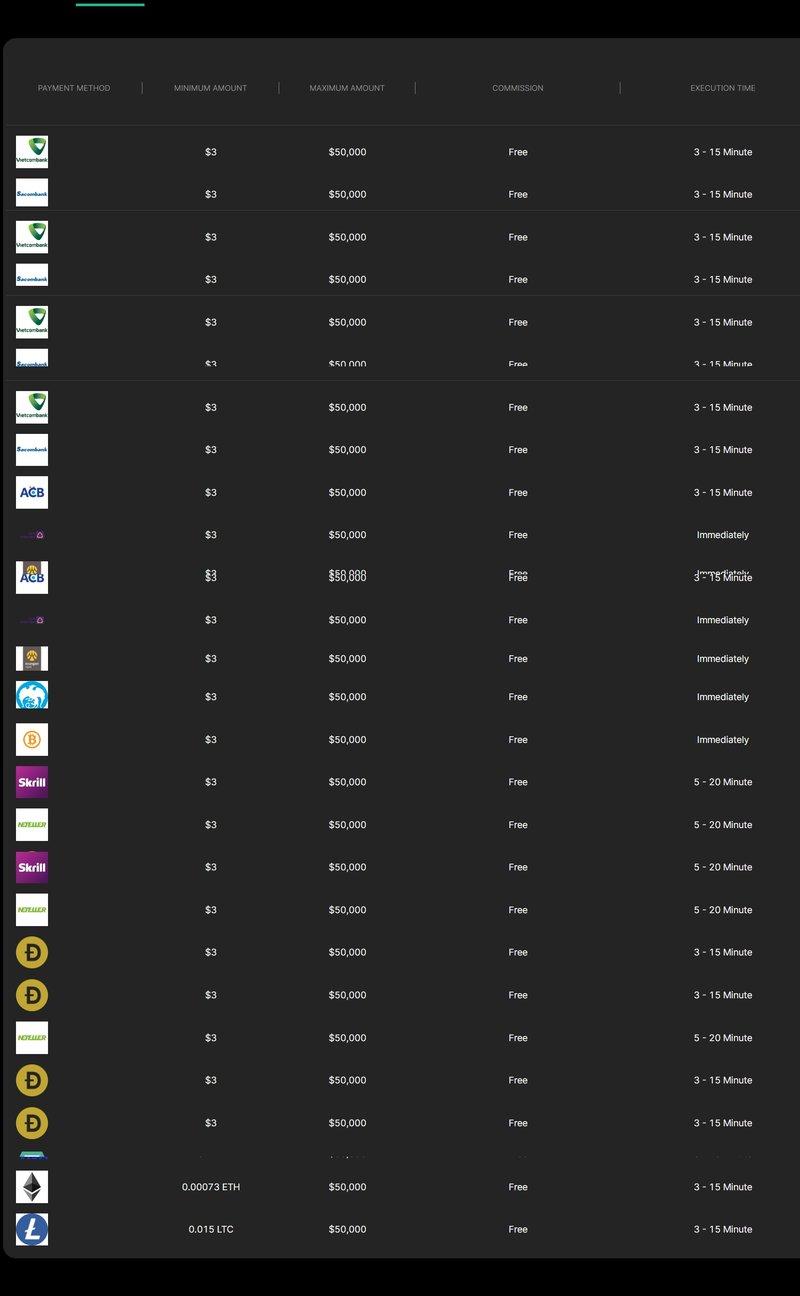

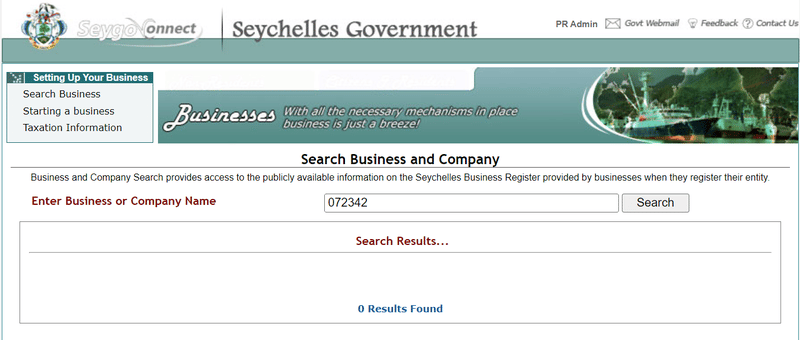

- Beirman Capital Review: Suspicion of Fraud

- Trump's tariff proposal sparks demand for safe havens, causing gold prices to rebound.

- WTI crude oil prices fell due to increased inventories and trade war concerns.

- Comex gold inventories hit a record high.

- [April 23, 2024 Daily Morning Market]

- Trump signs rare earth agreement, gold prices rise due to tariff uncertainty.

- Gold reaches a historic high as demand hits a record

- Corn prices rise, soybean prices fall, highlighting volatility in the CBOT futures market.

- GetPhyco Club: Rootie Technology's Ponzi Scheme Tool

- Trump's tariff proposal sparks demand for safe havens, causing gold prices to rebound.

热门文章

- On 9/28: HKEX will launch its new IPO platform FINI on November 22.

- Wheat rebounds, soybeans fluctuate, soybean oil under pressure.

- Corn long positions surge, while wheat and soybean shorts rise, influenced by weather and demand.

- CBOT grain futures fall, with South American production forecasts increasing market volatility.

站长推荐

Market Insights: Jan 17th, 2024

Gold prices fell, but the outlook remains positive due to Trump’s policies and expected rate cuts.

CBOT Position Divergence: Corn Short Positions Surge, Wheat Bulls Counterattack

Wheat rises, corn and soybeans under pressure, CBOT market trends diverge

Japanese Candlestick Charting Techniques

Oil prices have declined, influenced by the IEA report and geopolitical factors.

Chicago wheat futures continued to decline as fears of cold weather eased.

CBOT grain futures diverge, market sentiment becomes increasingly volatile.